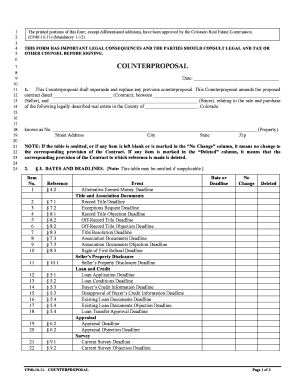

Application for Regulation of Individually Plotted Residential Dwellings (Tentative Application) Application Title of the Plot Sub-Plan Number of plots or plot lines (m) Land Use Type of the Dwelling Name of the Layout/Colony Survey No./s Description of the Plan for the Dwelling /s Number of plots / plot lines (m) (m) (m) 6. Application for Regulation of Land Use in a Town / Municipal Corporation Layout (Indicative Application) Application Title of the Plot Sub-Plan Number of plots or plot lines (m) Land Use Type of the Dwelling /s Name of the Layout/Colony Survey No./s Description of the Plan for the Dwelling /s Number of plots / plot lines (m) (m) (m) 7. APPLICATION FOR REGULATION OF UNAPPROVED SIDEWALK (Tentative Application) Application Title of Plot Sub-Plan Number of plots or plot lines (m) Land Use Type of the Dwelling /s Name of the Layout/Colony Survey No./s Description of the Plan for the Dwelling /s Number of plots / plot lines (m) (m) (m) 8. APPLICATION FOR REGULATION OF INDIVIDUALLY PILOTED RESIDENTIAL PLOT No. of plots or plot lines (m) Land Use Type of the Dwelling (tick the appropriate item) Name of the Layout/Colony Survey No./s Description of the Plot for the Dwelling /s Number of plots / plot lines (m) (m) (m) 9. APPLICATION FOR REGULATION OF INDIVIDUALLY PILOTED RESIDENTIAL PLOT No. of plots or plot lines (m) Land Use Type of the Dwelling (tick the appropriate item) Name of the Layout/Colony Survey No./s Description of the Plot for the Dwelling /s Number of plots / plot lines (m) (m) (m) 10. APPLICATION FOR REGULATION OF INDIVIDUALLY PILOTED RESIDENTIAL PLOT No.

Get the free hmda lrs status form

Show details

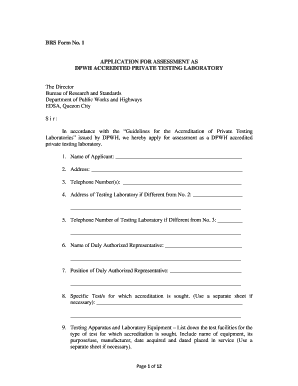

GREATER HYDERABAD MUNICIPAL CORPORATION 11. APPLICATION FOR REGULATION OF UNAPPROVED LAYOUT / PLOT APPLICATION NUMBER LRS/................................................................... WHETHER

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your hmda lrs status form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hmda lrs status form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hmda lrs status online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit hmda lrs application status form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Video instructions and help with filling out and completing hmda lrs status

Instructions and Help about forgot lrs application number telangana form

Fill hmda lrs status login : Try Risk Free

People Also Ask about hmda lrs status

What is the meaning of LRS in Telangana?

What is LRS and BRS in Telangana?

What are the charges for LRS in Telangana?

How to calculate LRS amount in Telangana?

Is LRS mandatory for registration in Telangana?

Who submits HMDA data?

What is the lei number for HMDA?

What transactions are not HMDA reportable?

What information is covered in the HMDA LAR?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is hmda lrs?

HMDA LRS stands for the Home Mortgage Disclosure Act Loan/Application Register System. It is a system used by financial institutions to report data on their mortgage lending activities. The Home Mortgage Disclosure Act (HMDA) is a federal law that requires certain financial institutions to collect, report, and disclose information about their mortgage lending practices to the public and regulatory agencies. The HMDA LRS is a database that houses this information and allows for analysis and monitoring of mortgage lending practices for compliance purposes.

Who is required to file hmda lrs?

Financial institutions that meet certain criteria set by the Consumer Financial Protection Bureau (CFPB) are required to file Home Mortgage Disclosure Act (HMDA) Loan/Application Register (LARs). These institutions include:

1. Banks, savings associations, and credit unions that originated at least 25 covered closed-end mortgage loans in the preceding calendar year or at least 100 covered open-end lines of credit in the preceding calendar year.

2. Non-bank mortgage lenders, brokers, and servicers that originated at least 25 covered closed-end mortgage loans in the preceding calendar year.

These criteria are subject to change, so it is recommended to refer to the CFPB's official guidelines for the most up-to-date information regarding who is required to file HMDA LARs.

How to fill out hmda lrs?

To fill out the HMDA LRS (Loan/Application Register), follow these steps:

1. Gather all the necessary information: Collect all the relevant data about the loan applications originated or purchased during the year, such as the loan amount, loan purpose, loan type, property type, occupancy status, applicant information, etc.

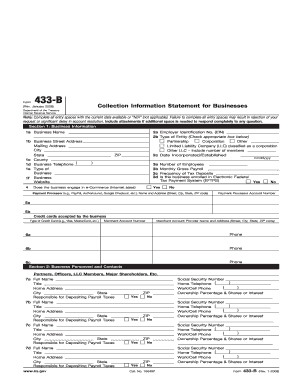

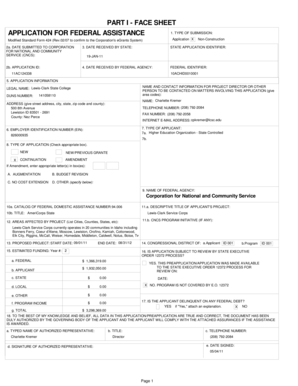

2. Understand the HMDA LRS form: Familiarize yourself with the layout and sections of the HMDA LRS form to ensure accurate completion. The form typically includes sections for identifying information, loan information, property information, applicant information, action taken, and more.

3. Complete identification sections: Fill in information about your financial institution, including name and ID number, as well as the date and reporting year.

4. Enter loan information: Provide details about each loan/application, including the loan amount, loan type (conventional, FHA, VA, etc.), purpose of the loan (purchase, refinance, etc.), and loan feature (fixed-rate, adjustable-rate, etc.). Include a unique loan identifier for each loan/application.

5. Provide property information: Indicate the property type (1- to 4-family, multifamily, manufactured housing, etc.), occupancy status (owner-occupied, not owner-occupied, etc.), and the location of the property.

6. Enter applicant information: Record details about the applicants, including names, ethnicity, race, sex, income, credit score, and age.

7. Specify action taken: Indicate whether the application was approved, denied, withdrawn, or the file closed for incompleteness. Provide additional information if needed.

8. Submit the HMDA LRS form: Once the form is completed, submit it as required by your regulatory authority, typically through an electronic reporting system.

Remember to review the completed form for accuracy and consistency before submission. Additionally, consult the official HMDA LRS instructions provided by your regulatory authority for further guidance specific to your reporting obligations.

What is the purpose of hmda lrs?

The purpose of the Home Mortgage Disclosure Act Loan Application Register (HMDA LAR) is to collect and provide data to facilitate fair housing and fair lending analysis. The HMDA LAR contains information about mortgage loan applications, their approval or denial, and details about the borrowers. This data helps identify trends, patterns, and potential instances of discriminatory practices in mortgage lending. Regulatory agencies, policymakers, researchers, and advocacy groups use this data for various purposes, including monitoring lending practices, enforcing compliance with fair lending laws, identifying disparities, and promoting access to credit for underserved communities.

What information must be reported on hmda lrs?

The Home Mortgage Disclosure Act (HMDA) requires certain information to be reported on the HMDA Loan/Application Register (LAR) for covered mortgage lenders. The specific information that must be reported includes:

1. Universal Loan Identifier: A unique identification number assigned to each loan or application for tracking purposes.

2. Applicant Information: Demographic information about the loan applicant, including race, ethnicity, sex, and age.

3. Property Information: Details about the property securing the loan, such as the location (address, census tract, and county).

4. Loan Information: Specifics about the loan, such as loan type (conventional, FHA, etc.), loan purpose (home purchase, refinance, etc.), loan amount, interest rate, loan term, and whether the loan involves a prepayment penalty or is subject to the Home Ownership and Equity Protection Act (HOEPA).

5. Action Taken: Information about the lender's decision on the loan, whether it was approved, denied, or withdrawn by the applicant.

6. Type of Purchaser: Indicates whether the loan was intended for retention by the reporting lender or if it was sold to another entity.

7. Other Applicant Information: Additional details about the applicant, such as their credit score, income, and debt-to-income ratio.

It's important to note that the specific requirements may vary depending on the type of lender and the volume of their loan originations. Additionally, certain fields may be marked as "not applicable" or exempted by regulations for privacy concerns.

When is the deadline to file hmda lrs in 2023?

As of now, there is no specific information available regarding the deadline to file HMDA LRS (Loan/Application Register) for the year 2023. The exact deadline for HMDA filings is typically determined each year by the Consumer Financial Protection Bureau (CFPB). It is recommended to check the official website of CFPB or stay updated with relevant regulatory announcements for the most accurate and up-to-date information regarding the deadline.

What is the penalty for the late filing of hmda lrs?

As of now, there is no specific penalty mentioned for the late filing of HMDA LRS (Loan/Application Register). Penalties usually vary based on the applicable regulations and can potentially include fines and other consequences. It is advisable to consult the relevant regulatory authorities or legal experts to understand the specific penalties for late filing in your jurisdiction.

Can I create an electronic signature for the hmda lrs status in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your hmda lrs application status form in seconds.

How do I edit hmda lrs status with application number straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing lrs application status, you can start right away.

Can I edit hmda lrs status of application on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as hmda lrs search form. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

Fill out your hmda lrs status form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hmda Lrs Status With Application Number is not the form you're looking for?Search for another form here.

Keywords relevant to lrs application receipt download form

Related to lrs brs service lrs shortfalls hyderabad photos

If you believe that this page should be taken down, please follow our DMCA take down process

here

.